Factors Influencing Commodity Prices on MCX: Comprehensive Guide to Market Dynamics and Price Fluctuations

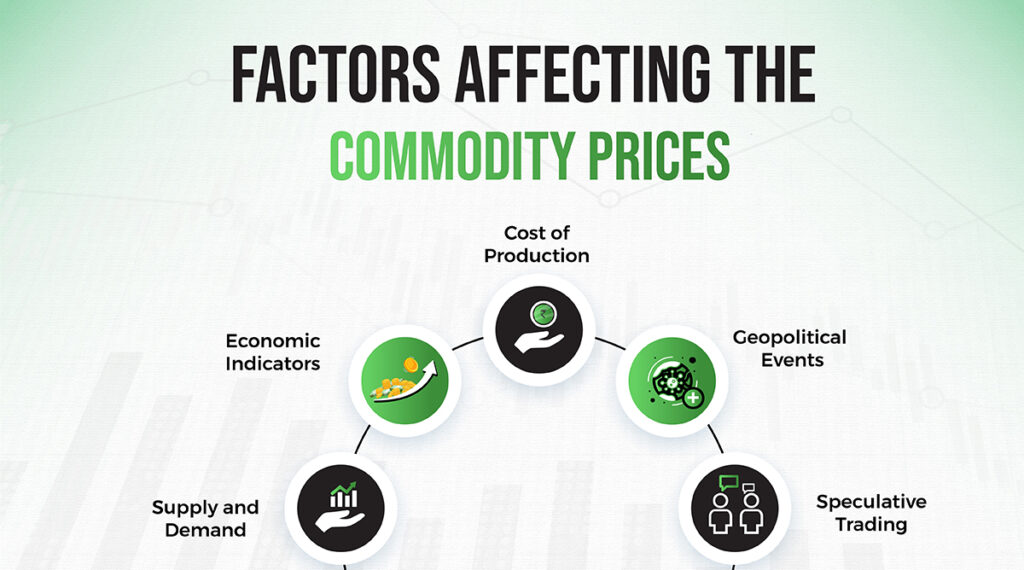

Multi Commodity Exchange (MCX) is the one of most popular commodity exchanges in India. From agricultural products to precious metals, there is a wide range of commodities available in the MCX. Changes in the commodity price are quite common. The prices of MCX commodities are influenced by a complex interplay of various factors, like- Supply and Demand Dynamics Geopolitical Events Economic Indicators Currency Fluctuations Weather Conditions Technological Advancements Regulatory Changes Market Speculation Inventory Levels Global Economic Trends Factors Influencing Commodity Prices on MCX:- Supply and Demand Dynamics: One of the most important factors which influence the commodities price is a balance between supply and demand. When there is higher demand than supply, the prices tend to rise. Vice versa, when supply is higher than demand, the price tends to fall. There are many reasons which affect the demand and supply in the market. Geopolitical Events: Geopolitical Events also play an important role in affecting the commodity price. Conflicts, trade disputes, sanctions, and changes in government policies can disrupt supply chains, which increase the price of commodities. Similarly, sanctions on countries producing key commodities can restrict supply and increase prices. Economic Indicators: Inflation rates, GDP growth, employment figures, etc are the economic indicators of the country. They also play a crucial role in shaping commodity prices. When there is higher inflation in the country, it increases the commodity prices as the cost of raw materials increases. Economic growth can boost demand for commodities and economic downturns can reduce. Currency Fluctuations: Yes, Currency Fluctuations also affect the price of commodities on MCX or other exchanges. When there is a strong US dollar, it makes commodities more expensive for holders of other currencies, which reduces demand and lowers prices. Whereas, a weaker dollar can make commodities cheaper for international buyers. Weather Conditions: Weather Conditions play an important role in agricultural commodities. Unfavourable weather conditions in areas like droughts, floods, and hurricanes can damage crops which reduces supply and leads to higher prices. Likewise, favourable weather conditions can lead to good harvests, increased supply and lower prices. Technological Advancements: Technological Advancements affect the product of commodity’s products, which influence supply levels and thus affect prices. For eg, Technological Advancements in mining increase the efficiency and output of metal production and result in lowering the price. Likewise, it works in all fields. Regulatory Changes: When there are Changes in regulations and policies, it has a direct impact on commodity markets and commodities prices. Changes in regulations and policies include changes in environmental regulations, trade tariffs, and policies related to commodity production and export. Market Speculation: Speculation by traders and investors can also affect commodity prices. Traders may buy or sell commodity futures based on their expectations of future price movements, which can create price volatility. Inventory Levels: Inventory Levels in the market also affect the commodities prices. When high inventory levels in the market, it is a sign of ample supply and can put downward pressure on prices. Vice versa, When low inventory levels, it is a sign of shortage, driving prices up. Global Economic Trends: Global Economic Trends like industrial growth and shifts in consumer behaviour also affect commodity demand. For eg- the industrialization of emerging economies increases demand for metals and energy, pushing prices up. In the same way, trends towards renewable energy can affect the demand and prices of fossil fuels. Conclusion: On the MCX, there is a wide range of commodities which are traded by the traders. The price of commodities always changes as per the market. The Commodity prices on MCX are influenced by many key factors, which range from fundamental supply and demand to economic and geopolitical events. Traders who trade on the MCX Exchange or other exchanges need to stay updated about these factors and what is going on in the market. The market condition directly affects the commodity’s price. So every trader should also change their trading strategy from time to time. Understanding these influences can help in predicting price movements and managing risks effectively. Always keep an eye on the news about the supply-demand balance, geopolitical events, economic indicators, currency fluctuations, weather conditions, technological advancements, regulatory changes, market speculation, inventory levels, and global economic trends. FAQs:- What is MCX? MCX stands for Multi Commodity Exchange of India, a leading commodity derivatives exchange where traders can buy and sell various commodities. How does supply and demand affect commodity prices on MCX? Commodity prices rise when demand exceeds supply and fall when supply exceeds demand, reflecting market balance. What geopolitical events can influence commodity prices? Conflicts, trade disputes, sanctions, and changes in government policies can disrupt supply chains and impact commodity prices. How do economic indicators influence commodity prices on MCX? Indicators like inflation, GDP growth, and employment rates affect raw material costs and demand, thereby influencing commodity prices. In what way do currency fluctuations affect commodity prices? A strong US dollar makes commodities more expensive for other currency holders, reducing demand and prices, while a weak dollar has the opposite effect. How do weather conditions impact agricultural commodity prices? Adverse weather like droughts or floods can reduce crop supply, increasing prices, while favorable weather can lead to good harvests and lower prices. What role do technological advancements play in commodity pricing? Advances in production technology can increase supply efficiency and lower prices, while technological disruptions can raise production costs and prices. How can regulatory changes influence commodity prices on MCX? New regulations or policy changes in areas like environmental laws, trade tariffs, and production policies can directly impact commodity prices. What is market speculation and how does it affect commodity prices? Traders’ buying or selling based on future price expectations can create volatility and impact current commodity prices. Why are inventory levels important for commodity pricing? High inventory levels indicate ample supply, which can lower prices, while low inventory levels suggest shortages, driving prices up.